Nevada is not different from the rest of the United States. The single most common type of bankruptcy filed in the United States and in Nevada is chapter 7 bankruptcy. Another name for ch 7 bankruptcy is a “straight bankruptcy” or a “liquidation bankruptcy”. Chapter 7 bankruptcy is the type or chapter most people think about when the word “bankruptcy” comes to mind.

Chapter 7 bankruptcy in Nevada is used by individuals, partnerships, and corporations who have no hope for repairing their financial situation. A Henderson Chapter 7 bankruptcy liquidates debtor’s estate under the rules of the Bankruptcy Code..

Keep in mind, certain debts cannot be discharged in a Chapter 7 bankruptcy. Some of the debts that aren’t able to be discharged in a Nevada Chapter 7 Bankruptcy include:

- Child support

- Fraudulent debts

- Debts for willful and malicious injury

- Certain types of taxes

- Most student loans

- Alimony or spousal support

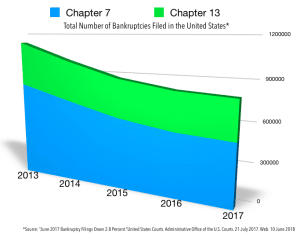

In Nevada, over 80% of all bankruptcies filed were chapter 7 bankruptcies. Approximately 18% of all Nevada bankruptcies were chapter 13 bankruptcy filings. The other approximate 2% of bankruptcy filings in Nevada were chapter 11 bankruptcy filings by businesses.