HENDERSON

BANKRUPTCY LAWYERS

CONTACT US

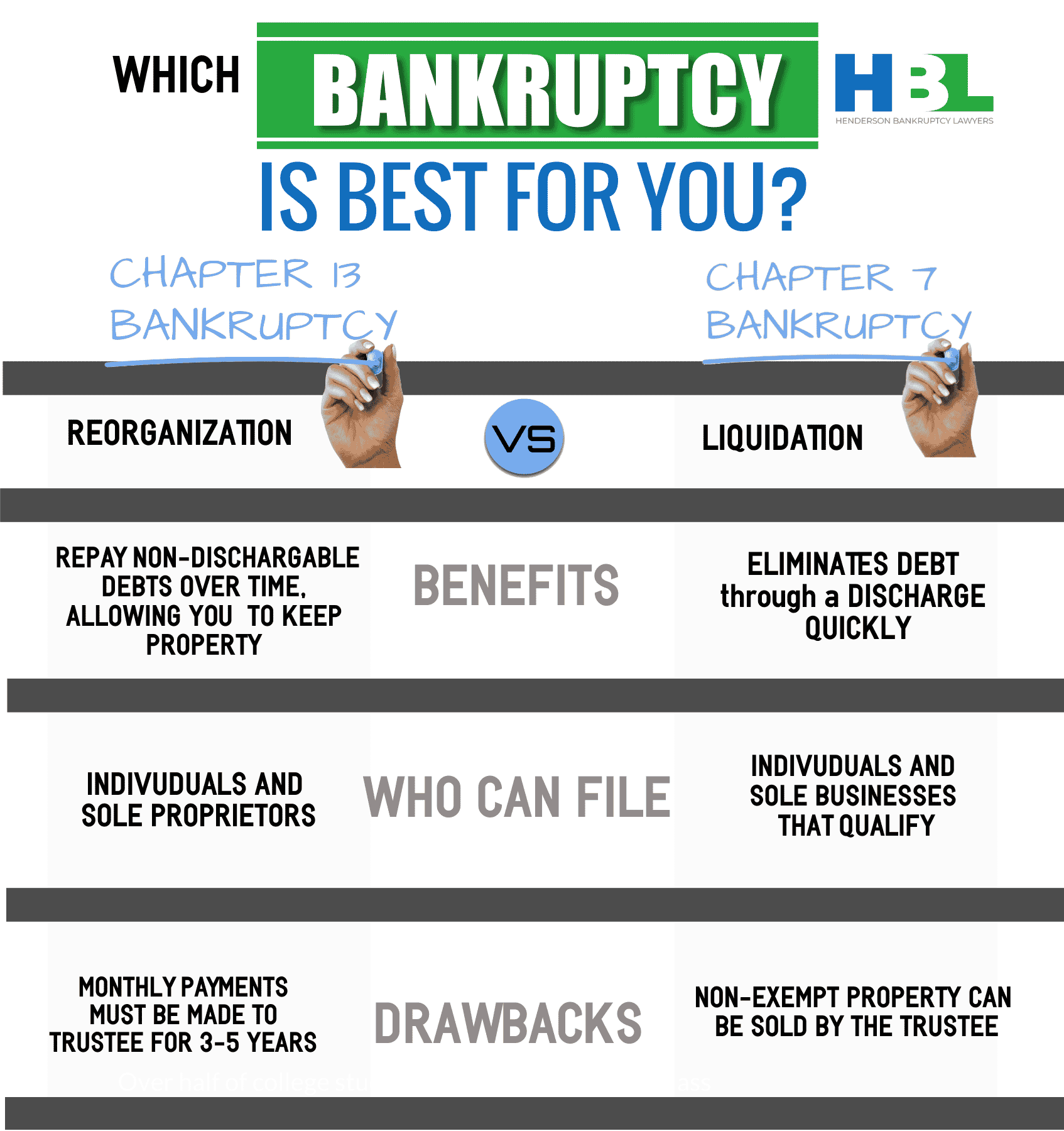

Chapter 13 or Chapter 7 Bankruptcy, Which Is Right for You?

Chapter 13 and chapter 7 are the two most used chapters of bankruptcy in Henderson, Clark County, and throughout Nevada. Figuring out which one your qualify to use and which chapter would benefit you and your family the most takes a little research. The bankruptcy means test will be used to see if you qualify for a chapter 7 bankruptcy or if you are above on the means test, you may have to choose a chapter 13 bankruptcy.

Chapter 13 Bankruptcy in Henderson

Chapter 13 is an option for eliminating debt, but it is different than Chapter 7 filing. Ch 13 is designed for filers who have regular income with enough left after monthly bills to pay back a portion of debt via a repayment plan. This type of reorganization bankruptcy offers benefits not available with Chapter 7. In the case where a client does not qualify for Chapter 7 bankruptcy protection, our attorneys look at Ch 13 as an option. You keep property, including non-exempt assets, and pay back some of all of your debt. A repayment plan is one of the main differences in bankruptcy chapters in Nevada. This plan organizes the amount that each creditor will be paid, the length of time the plan will be in effect, and the value of the debtor’s property. A trustee is involved in the repayment plan, and the bankruptcy court must confirm and approve the plan in order for the Chapter 13 bankruptcy to be successful and proceed.