Filing an Emergency Bankruptcy in Nevada

Henderson Emergency Bankruptcy Lawyers

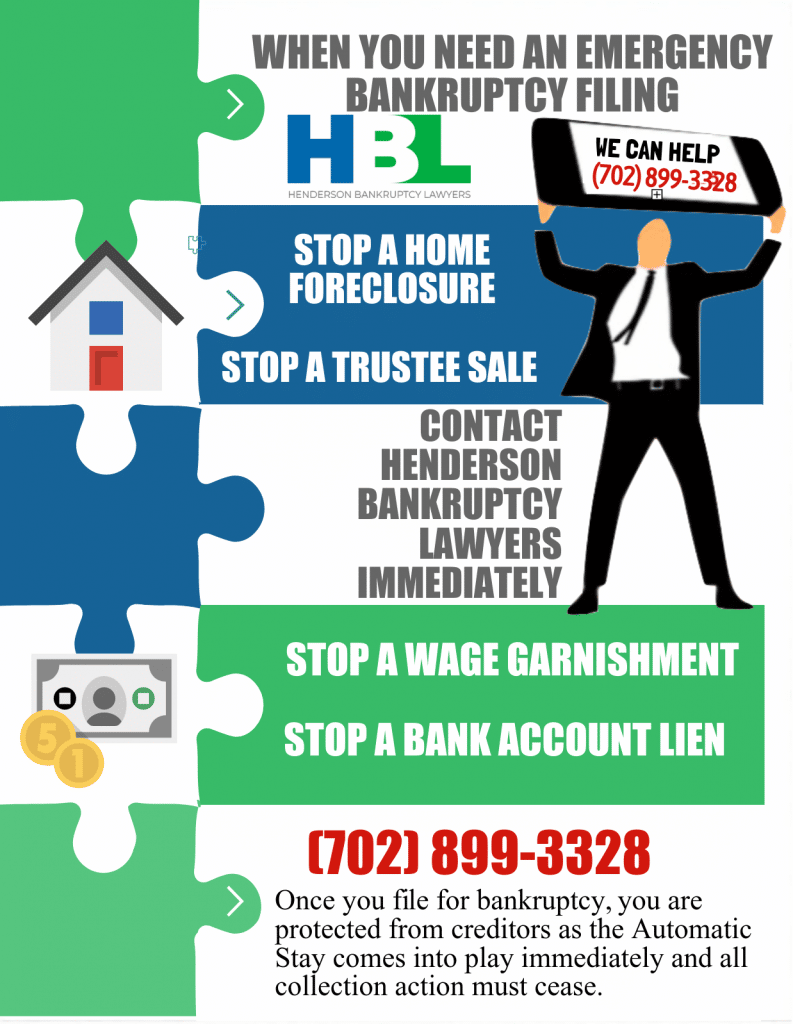

Sometimes, situations beyond your control can lead you to have to file for bankruptcy protection in a hurry. Often called “Emergency Bankruptcy”, these filings are helpful in stopping a wage garnishment, avoiding a repossession, or saving your home from foreclosure. It is difficult to live with out-of-control debt and creditors hounding you day and night. No one wants to file for bankruptcy, emergency or not. However, sometimes it is the best move for your current financial situation. Often, the situation is emergent and requires that you file bankruptcy right away! Filing bankruptcy in Nevada envokes and“automatic stay” which protects you from creditors. ALL collection activity must stop as soon as you declare bankruptcy. The process of filing for bankruptcy in Nevada can be daunting. Plus, preparation and organization of your documents in order to file can be quite time consuming. When you don’t have enough time to properly prepare for a bankruptcy filing, an emergency bankruptcy filing becomes a very viable option.For instance, a typical Chapter 7 bankruptcy petition will likely end up being more than 50 pages long. It is so cumbersome because it reflects information gathered from a long list of your financial documents. To file the petition on your own, you will need to access documents such as: your tax returns, bank statements, vehicle registrations, current paystubs, etc. Hiring an experienced Nevada bankruptcy lawyer will not only save you hours of work, it will also assure that your bankruptcy is filed right the first time.

When Time is of the EssenceThere is an initial difference in filing a regular bankruptcy and an emergency bankruptcy filing. An emergency Nevada bankruptcy filing initially only requires a skeleton petition. To file this skeleton petition, you will only need a few documents like: your driver’s license or other form of identification, your social security card or a W2 if your SS card is unavailable to you,plus, 6 months of pay stubs. In addition to these documents, completion of the 1st of (2) credit counseling classes must be completed. The 1st counseling class must be completed before our attorneys can file your bankruptcy. Lastly, your bank accounts must have a balance under $300 if you are filing on your own, and under $600 if it is a joint filing with your spouse.Sound confusing? It is not, especially to an experienced bankruptcy lawyer. A skilled attorney should be able to have a skeleton petition filed fairly quickly if you have submitted all these documents. Once the skeleton petition is filed, you will be provided with a case number. This case number is important as this is the number that you will give to the creditor that is trying garnish, repossess, or foreclose on you. After your skeleton petition has been filed, you are given 14 days to complete your bankruptcy petition. If you don’t complete this petition, your bankruptcy may be dismissed and the automatic stay that was protecting you and your property will be lifted. You should try to avoid getting your bankruptcy dismissed at all costs.Ideally, getting the rest of your documents in to your attorney within 7 days is preferred. That gives your lawyer adequate time to analyze the documents, draft your bankruptcy petition, and have you review it to make sure all is accurate. Whereas, you successfully submit your full petition in time, your 341 meeting of creditors will be 30-45 days after the skeleton petition is filed. Your creditors will have 60 days after the 341 hearing to object to your debts being discharged. Your case will be eligible for discharge after those 60 days have passed.It is best to contact our Henderson bankruptcy lawyers to find out how our Nevada bankruptcy attorneys can use Emergency Bankruptcy services to stop a trustee sale or foreclosure sale, wage garnishments, bank account liens, and other disruptive financial or real estate activities by declaring bankruptcy on your behalf with short notice. Additonally, declaring bankruptcy in Nevada is also helpful in stopping eviction from a residence by an owner or landlord. Get all the details from our experienced Nevada bankruptcy attorneys.It’s Not Too Late for a Fresh Start

Regardless of your situation, there is usually something that can be done. If you currently have a wage garnishment, stop the garnishment before they take any more of your earnings. Also, if you are currently dealing with a house foreclosure, file an emergency bankruptcy and stop the sale of your family home. In situations where a bankruptcy filing is needed immediately it can happen through what our Las Vegas and Henderson bankruptcy attorneys call an emergency filing.

In situations where bankruptcy is the last minute action to stop such collections activities, our attorneys have successfully helped hundreds of clients who have found themselves in an “Emergency” type of situation by utilizing our debt relief services. If you are looking to stop a trustee sale, stop a bank account lien, or get rid of a wage garnishment; consider filing for bankruptcy protection before it is too late.If you are considering filing an emergency petition, you likely have something important to protect. That’s why it’s important to be represented by a competent and experienced law firm. Don’t get all stressed out about creditor calls and outstanding bills. Call our Henderson Bankruptcy office today. Our Nevada bankruptcy attorneys and staff can assist you with an emergency bankruptcy filing.

We are a debt relief agency according to the U.S. Bankruptcy Code. We help people file for bankruptcy.