Getting in shape is hard, and it can be even harder if you feel nervous or embarrassed about going to the gym. Driving to the gym, dealing with traffic, and parking all add extra time to your workout. Additionally, you might feel anxiety about cleanliness and hygiene at the gym and not want to work out in a puddle of a stranger’s sweat. Some bodybuilders scream during every rep, influencers think their followers want to watch an hour-long video of them working out, and usually some weird guy hanging around and trying to talk to women. I’m getting stressed out just thinking about it. Home gym equipment can solve all of those problems, but this industry isn’t doing as well as one might think in a post-pandemic world. One of the pioneers in the home gym industry, BowFlex, has recently filed for Chapter 11 bankruptcy.

BowFlex was started in the 1980s and is based in Vancouver, Washington. It is perhaps best known for its synonymous workout system that can be used for up to 70 different exercises. After a few years of struggling, the company has decided that it is time to sell, and bankruptcy can help facilitate that sale. Johnson Health Tech has made a $37.5 million bid for the company, but this won’t be finalized until about April 12, 2024. The company currently has 202 employees with 171 different job titles, and they have been put on notice that their jobs could be in jeopardy. If you’re in the market for home gym equipment, now might be a great time to buy, as much of BowFlex’s equipment is currently on sale.

Other Names in the Fitness Industry to Declare Bankruptcy

With the rise of social media making people more concerned with body aesthetics than ever, you would think that an established fitness company would not be laying off employees and initiating a bankruptcy sale. However, home gym equipment makes exercising more convenient, but not entirely effortless and automatic. Working out from home is still working out, and many American adults simply don’t like to do so, as evidenced by the approximately 74% overweight rate in the United States. In the past few years, prescription medications originally meant to treat diabetes have taken the world by storm as a quick and easy way to slim down. Ozempic, Wegovy, and Mounjaro are just a few of the medications in this category. Why buy a home gym when you can buy shots that will eliminate effort?

Weight loss drugs may have detracted from fitness companies in recent years, but ultimately target certain subsets of customers. There are probably plenty of celebrities who get a boost from weight loss drugs, but nobody is getting a Miley Cyrus Pilates body without a significant workout routine. Gisele Bundchen does Brazilian Jiu Jitsu but my physical therapist said I can’t try that yet. Other factors have caused fitness businesses to declare bankruptcy in the past. Many fitness companies that were forced to close temporarily during the pandemic never fully recovered. The fitness industry is highly saturated and constantly evolving, so some companies struggle to keep pace. Some companies are simply mismanaged and end up going under. A few of the names in the fitness industry to declare bankruptcy in the past include:

- Gold’s Gym: If you know about the bodybuilders on Venice Beach, you’ve probably heard of Gold’s Gym. The gym chain was in business for over 50 years before filing bankruptcy due to the pandemic. It had to close about 30 of its 700 locations permanently. The Chapter 11 bankruptcy was filed to protect the company and its brand rather than to shut down operations.

- 24 Hour Fitness: This gym had been in business for more than 35 years before falling victim to the pandemic. It was able to use Chapter 11 bankruptcy to clear more than $1.2 billion in debt. The gym chain had 300 locations but was forced to shut down during the pandemic, and therefore shifted its focus to virtual workouts and training.

- Bally Total Fitness: If you don’t recognize this company’s name, it might be because its bankruptcy filing came more than a decade before the pandemic. The Chicago-based fitness chain filed for Chapter 11 bankruptcy not to shut down but to reorganize and reduce debts by $660 million. At the time of its filing, it had 328 locations and 2.9 million members.

- Xponential Fitness Studios: Xponential the company did not file for bankruptcy itself. However, this company owns several fitness brands that allow franchisees to purchase gym locations. Some of Xponential’s most popular brands include Pure Barre, Club Pilates, Stretch Lab, Row House, and CycleBar. Xponential is currently involved in a class action lawsuit due to allegedly misrepresenting investment information to franchisees, which caused several of them to end up bankrupt.

Personal Bankruptcy for Small Business Owners

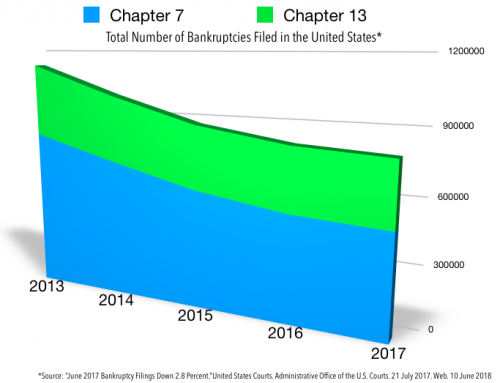

While many of the famous fitness brands described above used Chapter 11 bankruptcy, chapter 7 bankruptcy will suit the needs of most small business owners with less cost and complexity. A Chapter 7 bankruptcy debtor will need to be able to show they qualify based on income, and will likely want to ensure that all of their assets, especially those used in the operation of their business, will be covered under their state’s bankruptcy exemptions. That will make it relatively simple to close the business and open a new business with a similar name. For example, Bill’s Mobile Physical Therapy could be Mobile Physical Therapy by Bill. If you have questions about qualifying for Chapter 7 bankruptcy in Las Vegas or Henderson, call 702-899-3328 for your free consultation with the Law Office of Erik Severino.

Chapter 7 bankruptcy is popular because it can clear unwanted unsecured debt, and it only takes 3 to 6 months to complete. This allows a debtor to erase medical bills, credit cards, and other debts they can’t afford. A debtor who strategizes their case correctly will be able to utilize their filing to build a more positive credit history in the future. For those who don’t qualify for Chapter 7 bankruptcy, chapter 13 is an option, although it may not be as convenient for small business owners. To learn more about filing for bankruptcy in Las Vegas and Henderson, Nevada, call 702-899-3328 to schedule your free phone consultation.

Experienced Bankruptcy Lawyers in Las Vegas and Henderson

Filing for bankruptcy can be a stressful ordeal without the proper bankruptcy counsel. But bankruptcy lawyers can also be expensive, even from the very beginning. At Henderson Bankruptcy Attorneys, we aim to make filing for bankruptcy more attainable in the Las Vegas and Henderson areas, which is why we offer free initial consultations by phone. This is your chance to learn more about the process and have your bankruptcy questions answered. If bankruptcy is a fit for you, we can provide you with an affordable quote for our services and payment plan options. Tired of hiding from creditors and living with debts and poor credit? Get the ball rolling on your bankruptcy case today. To get started, contact us through our online form or call us at 702-899-3328 for your free consultation with our Las Vegas and Henderson bankruptcy firm.

Henderson Bankruptcy Attorneys

1489 W. Warm Springs Rd., Ste. 110

Henderson, NV 89014

Phone: (702) 899-3328

Email: [email protected]