HENDERSON

BANKRUPTCY LAWYERS

CONTACT US

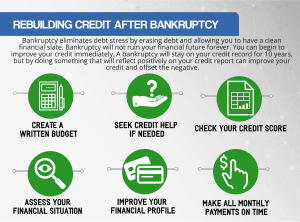

STEP 3 – REBUILD CREDIT

Is it possible to reestablish credit after filing bankruptcy? The answer is yes. You’ve already come to terms with your unmanageable debt and taken control of it by successfully filing for bankruptcy. Now that you have your financial slate wiped clean, it is time to move forward and prepare for an improved financial future.

Many debtors who have completed the bankruptcy process are concerned about what kind of hit their credit and credit score will take. If bankruptcy was the best option for your debt relief, that decision was probably made knowing there would be some work to do to rebuild your credit after receiving the discharge.

You do not have to give up on your dreams of owning a house, renting a better apartment, or buying a car. Instead of allowing bad credit to follow you, reclaim and recover your credit so that your financial and life goals may be a reality.

That reality is this: many of our clients have improved credit after bankruptcy. In order to boost your credit, you have to understand the steps to make this happen, and our Las Vegas debt relief lawyer will help. After getting instruction and information and the confidence to rebuild your credit, you have to make it happen. Like everything else in life, if something is a priority, the steps must be taken to successfully rebuild your credit.

CREDIT RECOVERY

Our Las Vegas Bankruptcy Attorneys has partnered with 720 Credit Score, a leading credit recovery company. We offer a program that is solid education in credit score rehabilitation. Clients who follow this step-by-step format typically see a 720 credit score within 1-2 years of filing for bankruptcy. Not only are we going to alleviate your present debt, we are going to re-build and establish your future with good credit.

What the 720 Credit Score program offers a plan to improve credit:

- Learn about the utilization rate and how it impacts your credit score

- What actions to take to make creditors pay attention to your new, positive credit activity

- What accounts you need to have on your credit report: what type and how many

- New credit cards: how to use them to effectively improve your score.

- Ensure that your pre-bankruptcy filing debts are being reported correctly and removed.

- Instructions to follow and implement to help rebuild credit.

Good Credit is Important

Why is it so important to rebuild your credit? By having good credit, you are able to get reasonable and fair interest rates, which means saving you money. We understand that credit scores are important, and so are your future financial goals. We believe in helping our clients with their financial life after bankruptcy. We highly recommend and endorse the credit rehabilitation program we offer through the 720 program.

Our Las Vegas debt relief firm makes this program available to you. This credit education program will help any client who may struggle with credit matters, and who wishes to achieve a higher credit score. After bankruptcy, you are debt free. There is no better time to get a “fresh start” with your credit as well.

The truth is, that many people have a poor credit score, and they don’t even have a bankruptcy on their report! You, on the other hand, have eliminated your debt and dealt with your financial issues. Thus, the stress of any debt burden is gone. Now you just have some work to do to repair and renew your credit and you will be closer to accomplishing your financial goals.

FIX YOUR CREDIT AFTER FILING BANKRUPTCY

It is not impossible to rebuild your credit after a bankruptcy. Before bankruptcy, your credit score may have been suffering because of debt. Now, you have the power to improve. You know exactly where you stand and you now have your head above water. In time, you will have rebuilt your credit.

The program will educate clients the answer to rebuilding credit. This includes opening new lines of credit, and paying bills on time. Credit companies consider no credit to be equal to bad credit. By obtaining new credit and using it responsibly, they can get new information about your spending. They will pay attention to your recent activities and will observe that your financial actions show you are on your way to improving your credit record. Of course your credit report will reflect your bankruptcy, but it will also show the new responsible activities.

720 Credit Score program, as part of your plan to rebuild credit, will give you more specific information and instructions on opening new lines of credit. 720 Credit Score is more than just advice, it is a course designed to teach you what to do, and help you follow through with the implementation.

Another key to improving your credit: never, never, (never) make a late payment again. Paying your bills from here on out on time and in full indicates that you are not a credit risk. Making a budget and sticking to it is an important step.

CONTACT OUR LAS VEGAS BANKRUPTCY ATTORNEYS TO GET STARTED

Our bankruptcy law firm can help you rebuild your credit through 720 Credit Score. This is really an amazing tool that has assisted clients on their financial journey. We believe in our clients. We don’t want to just get you through a bankruptcy and shove you out the door. Because of our extensive experience filing bankruptcies in Arizona, we understand that our clients need help after the process is over. There is life after bankruptcy. We can help you on the road back to recovery.