Filing Bankruptcy in Las Vegas

The general public has lots of misconceptions about bankruptcy. In 2020, bankruptcy filings in Nevada is very likely to be significantly more commonplace. In lieu of the likelihood, we would here to make clear what this method entails so you are able to start considering whether it’s a feasible choice for your own personal condition or maybe for that of a buddy or family member.

What does the procedure for individual bankruptcy look like for those in Las Vegas and Henderson?

A bankruptcy case starts when the debtor pays a filing fee and files specific document with the bankruptcy court. Along with this particular documents, considered a petition, you should offer details of your income and property. You have to in addition undergo required credit counseling before filing Chapter seven bankruptcy or maybe Chapter thirteen bankruptcy, and those are the 2 most filed kinds of individual bankruptcy filed in Nevada. When you do all this, an “automatic stay” goes into effect, stopping each collections actions. The Automatic Stay is one of the most powerful tools when filing bankruptcy in Las Vegas, Nevada.

Ultimately, when you see all of the specifications agreed to in the bankruptcy petition, your remaining debts is discharged. Thus, after discharge, your case is concluded. Be aware that these needs differ based on the chapter of bankruptcy you file. In filing Chapter seven bankruptcy, most of the debts of yours will go away if you file. In filing Chapter thirteen bankruptcy, you are going to be restructuring the debt of yours and repaying a percentage of it over several years. The remaining debt would be discharged at the conclusion of that period.

Filing Chapter 7 and Chapter 13 Bankruptcy in Nevada

While considering filing bankruptcy in Las Vegas, you may have already tried a few things to remedy the situation. Thus, if you’ve considered refinancing your mortgage or taking on a second job, declaring bankruptcy could be your only option. Therefore, when you’re besieged by the people you owe or experiencing other financial stresses, bankruptcy could indeed be a viable choice as a form of Nevada Debt Relief. Therefore, if you’ve determined that this is your best course of action, the next question would be figuring out how to proceed.

Which Chapter of Bankruptcy is Best for You?

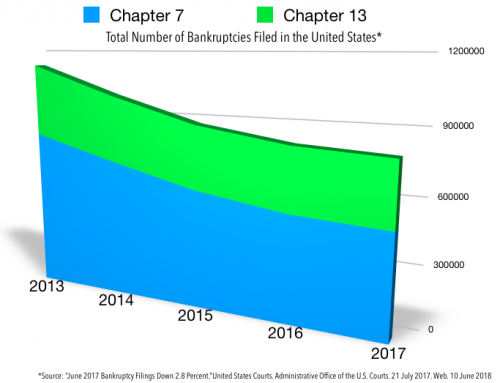

First you must decide which of the two bankruptcy chapters best applies to your situation: Chapter 7 or Chapter 13. The aforementioned Chapter of bankruptcy are the 2 most popular chapters of bankruptcies filed in Nevada and throughout the United States. Each bankruptcy has their pros and cons. However, one of the chapters could be right for you.

Chapter 7 bankruptcy is also known as “liquidation bankruptcy“. Individuals filing for Chapter 7 must sell their assets that are “secured,” such as a house or a car. After that, the rest of the unsecured debt is discharged and they won’t have to pay it back. Chapter 7 is a preferred method of debt relief to those with large amounts of unsecured debt.

By contrast, a Chapter 13 bankruptcy is known as a “reorganization bankruptcy” . If a Chapter 13 bankruptcy, you’ll create a repayment plan which will allow you to pay your creditors an amount that you can afford over a set period of time (typically 3 – 5 years). This payment plan is in lieu of selling your home or property. Once you have made all of your Ch 13 payments, your debt will then be discharged. Chapter 13 bankruptcy is a lot more complicated than Ch 7. Contact an experienced debt relief attorney for assistance with your bankruptcy filing.

Not sure which Chapter of bankruptcy is right for you? Let us help you with your decision. Also, you may be able to get further clarity for a decision about what Chapter of bankruptcy may be the best for your situation.

Bankruptcy Sounds Complicated. Do I Need an Attorney to File?

Filing bankruptcy in Vegas and Henderson will be increasing in the upcoming days. If you wish to file yourself, you can do so without an attorney. Legally, this is fine. However, it is our opinion that you may be better served using the experienced knowledge of a Las Vegas Bankruptcy attorney.

The experienced of a Nevada Bankruptcy Attorney comes in handy if you are considering Bankruptcy Chapter 13 or Bankruptcy Chapter 7 bankruptcy in Nevada and might be close on qualifying for bankruptcy through the Bankruptcy Means Test. Additionally, a seasoned Debt Relief Lawyer in Nevada would be integral when stripping a lien in a Chapter 13 bankruptcy. Plus, using an experienced bankruptcy lawyer to file helps to assure that all bankruptcy paperwork is filed properly, that your creditor list is accurate on your bankruptcy petition, and to best represent you in court.

Pro Se Bankruptcy Filings

When declaring bankruptcy in Nevada, you are not required to have a bankruptcy attorney. In some simple Chapter 7 bankruptcy cases, a person could file on their own in a “Pro Se” bankruptcy filing. This is an option and if you are willing to put in some time and research, it is possible. However, in many cases, it’s a good idea to have an experienced bankruptcy attorney or debt relief lawyer. An individual with bankruptcy experience is the better option to filing a successful bankruptcy.

If you are wanting assistance in filing for Chapter 7 or declaring Chapter 13 bankruptcy in Nevada. Contact our Las Vegas Debt Relief Team for assistance. Our friendly staff and experienced attorneys will definitely be an asset on your journey to a “Fresh Start” and financial freedom.